A survey by DiaNEOsis, an Athens-based research and policy institute, shows that 42 percent of respondents in 2017 believe that tax reformn in Greece should be a priority and immediately implemented, while 41 percent of respondents this year agreed with a statement that "tax evasion is a necessary defense against excessive taxation".

Additionally, 37 percent of respondents said they believe the primary reason behind tax evasion is the high tax rates imposed in Greece, whereas 86 percent of respondents said they believe lower tax rates will help attract foreign investments.

DIANEOSIS.ORG

The latest survey by DiaNEOsis, in cooperation with the Foundation for Economic & Industrial Research (IOBE), again points to a Greek tax system that is complicated, unfair and dysfunctional over many years.

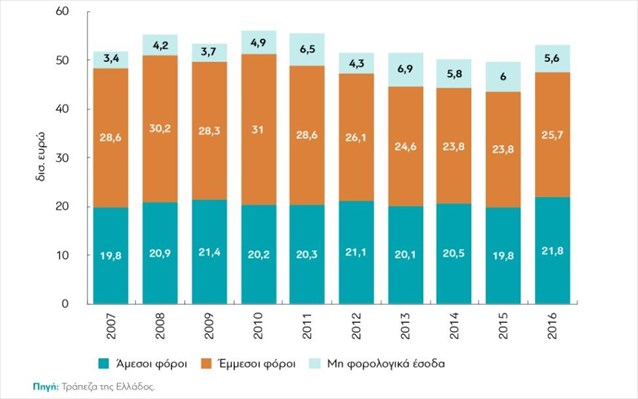

In terms of "euros and cents", the survey reports that extraordinary direct taxes increased by 94 percent between 2008 and 2016, whereas revenues derived from taxes on property increased seven-fold.

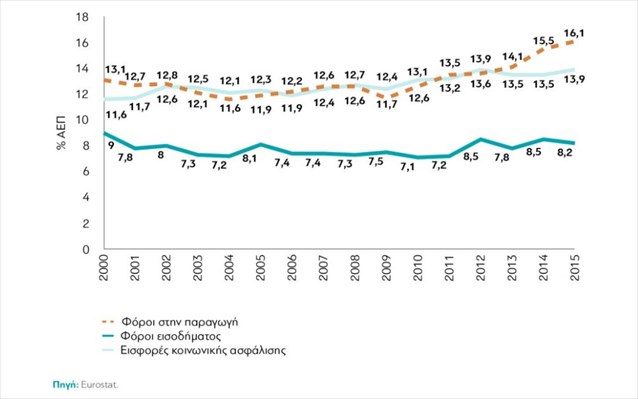

Taxes on economic production in 2015 reached 16.1 percent of GDP, up from 12.7 percent, while Greece figures third on a list of EU member-states in terms of the highest social insurance contributions.

DIANEOSIS.ORG

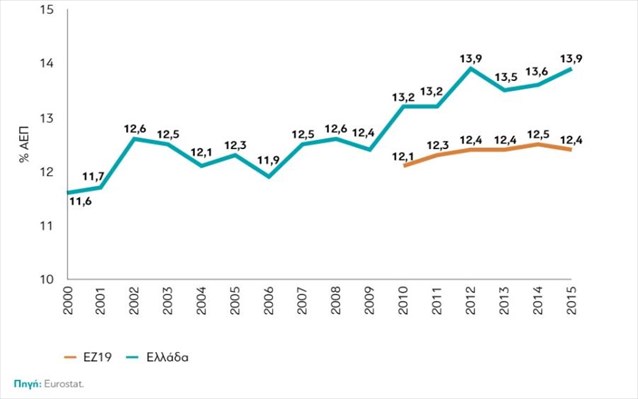

While GDP between 2008 and 2016 shrunk by more than a quarter (27 percent), tax revenues collected by the state only receded by 7 percent, as tax rates dramatically increased. Currently, crisis-battered and still bailout-dependent Greece features corporate tax rate of 29 percent, when the EU average is 22.6 percent. The total tax co-efficient for businesses in Greece (including social security contributions) was higher in 2017 than the relevant figure for advanced Sweden - 50.7 to 49 percent.

Moreover, in 2015 exactly 88.2 percent of taxpayers in Greece declared annual income lower than 25,000 euros, with the large bloc of citizens paying, however, 32.7 percent of taxes in the country. Conversely, a mere 11.8 percent of taxpayers in the country paid 67.3 percent of all taxes.

DIANEOSIS.ORG

At the same time, 71 percent so-called self-employed professionals - from physicians to plumbers to craftsmen - declared annual income below 9,000 euros, a fact repeatedly cited by Greece's creditors as implying widespread tax evasion. The figure is even more pronounced for professional farmers, with 93 percent declaring less than 9,000 euros in annual income.